About Momodrome

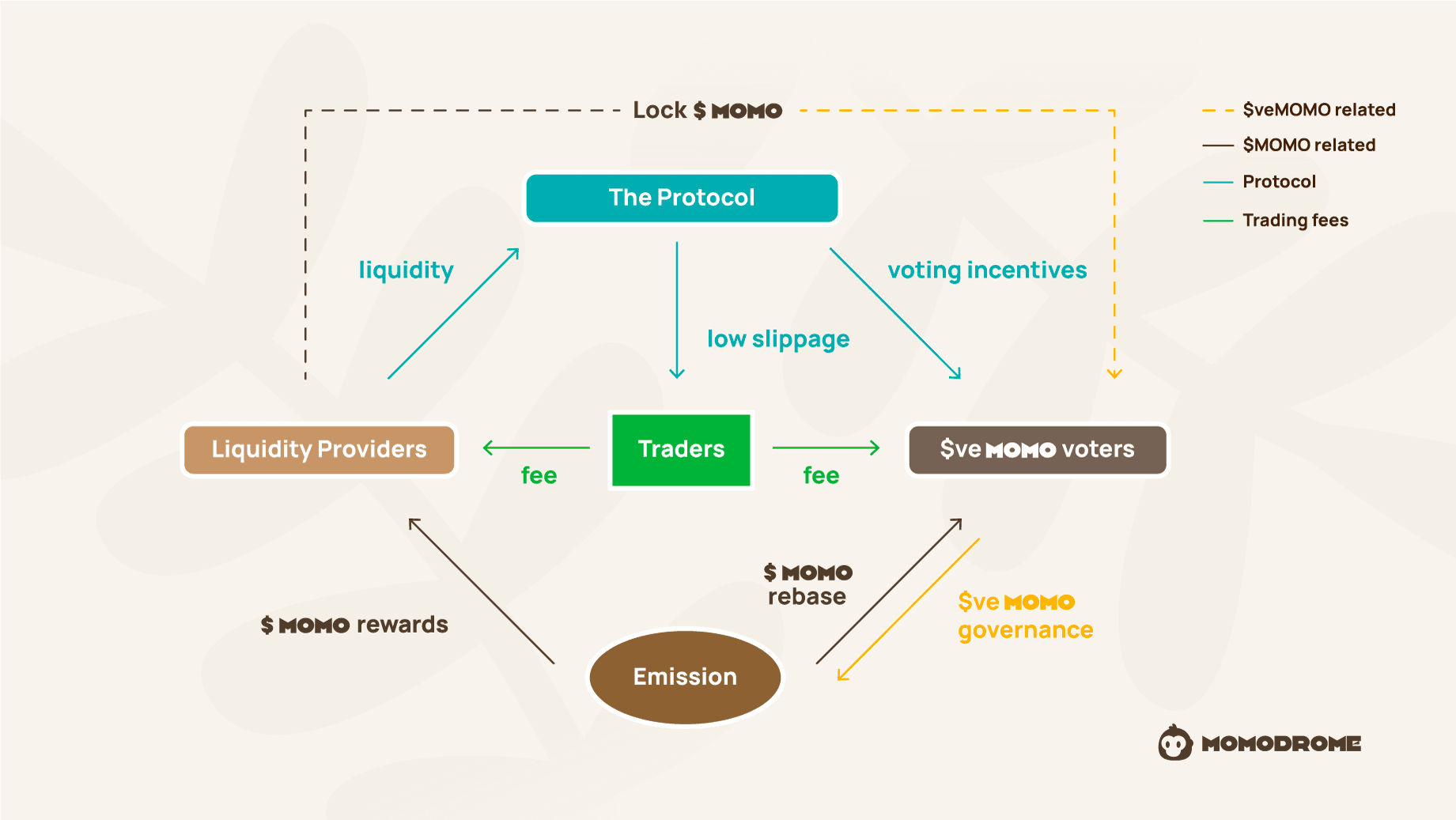

Momodrome is a DEX on the Morph ecosystem using the ve(3,3) model to align incentives among users, optimize liquidity, and promote long-term token locking.

Please note: Currently, Momodrome offers trading and liquidity addition-related features but has not yet enabled ve(3,3) governance. Stay tuned to our official announcements, and we will provide updates when ve(3,3) governance is launched.

What is a ve(3,3) DEX?#

A ve(3,3) decentralized exchange (DEX) is an innovative model inspired by the Solidly protocol. It integrates the “Vote-Escrowed (ve)” mechanism with the game theory principle “(3,3)” to align incentives among liquidity providers (LPs), protocol governors, and token holders. Key features include:

- Dynamic Incentive Allocation: Users lock protocol tokens (veTokens) to gain governance rights and earn a share of trading fees, encouraging long-term token holding.

- Liquidity Optimization: The protocol dynamically adjusts liquidity incentives based on governance voting, attracting liquidity in the most efficient manner.

- Positive-Sum Mechanism (3,3): Encourages cooperative behavior among participants, maximizing value within the ecosystem.

In the ve(3,3) model, the longer a user locks their tokens, the higher their voting power and revenue share. This design incentivizes long-term participation, reduces token sell pressure, and enhances protocol sustainability.

Vision & Mission#

The deployment of Momodrome will bring significant advantages to the Morph Network:

- Increased TVL (Total Value Locked): The dual locking mechanism and enhanced rewards attract more capital to the Morph network, boosting its overall TVL and signifying increased user confidence.

- Enhanced Liquidity: The ve(3,3) model encourages deep and long-term liquidity provision, leading to more efficient markets and a smoother trading experience on Momodrome.

- Greater User Engagement: The governance aspects of veMOMO encourage active participation in the Morph ecosystem, fostering a strong and engaged community.

- Sustainable Growth: By aligning incentives for long-term participation, the ve(3,3) model fosters sustainable growth for both Momodrome and the broader Morph network.

- Attracting New Projects: A successful ve(3,3) DEX can serve as a catalyst for attracting other projects to the Morph network, further expanding its ecosystem and utility.

- Increased Trading Volume: The improved liquidity and efficient price discovery facilitated by the ve(3,3) model are likely to attract more traders, resulting in higher trading volume on Momodrome and potentially across the Morph network.

As a core DEX built on the Morph Network, Momodrome will harness the potential of the ve(3,3) model to deliver a superior trading experience while positioning Morph as a foundational ecosystem for the next generation of decentralized networks.